Owning a home isn’t just about having a roof over your head—it can also be a powerful financial tool. If you’ve built up equity in your property, a home equity loan can help you access funds at lower interest rates than personal loans or credit cards. Whether you need money for renovations, education, medical expenses, or debt consolidation, this guide covers everything you need to know about home equity loans in India, including interest rates, eligibility, top lenders like SBI and HDFC, and how to calculate your loan.

What Is a Home Equity Loan?

A home equity loan allows you to borrow against the value of your home. Unlike a personal loan, which is unsecured, this loan uses your property as collateral, which means lenders offer better interest rates.

How It Works:

- The bank evaluates your home’s current market value.

- They subtract any outstanding mortgage balance.

- The remaining amount is your home equity, which determines how much you can borrow.

Example: If your home is worth ₹1 crore and you owe ₹30 lakhs on your mortgage, your equity is ₹70 lakhs. Banks may lend up to 60-75% of this amount (₹42-52.5 lakhs).

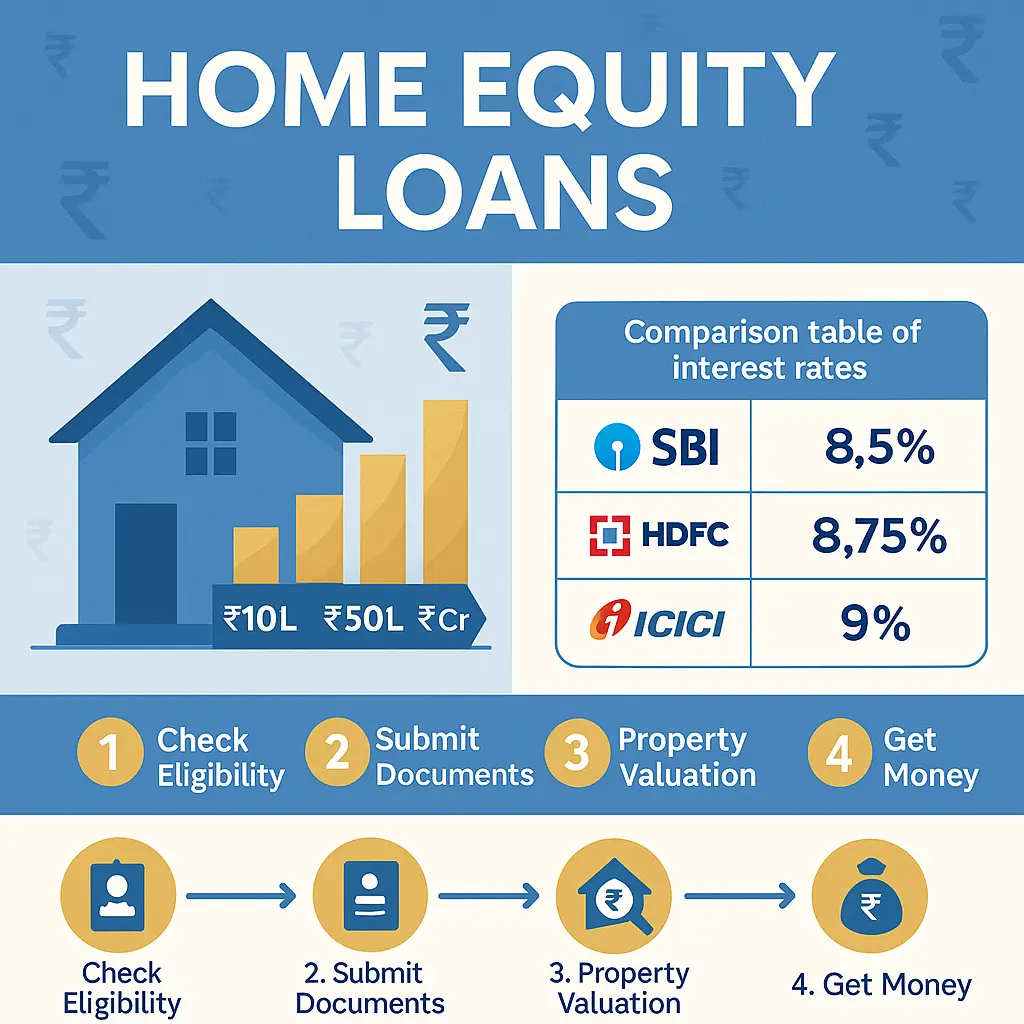

Current Home Equity Loan Interest Rates in India (2024)

Interest rates vary depending on the bank, your credit score, and loan tenure. Here’s a quick comparison:

| Bank | Interest Rate (p.a.) | Maximum Tenure |

|---|---|---|

| SBI | 8.50% – 10.50% | Up to 15 years |

| HDFC | 8.75% – 11% | Up to 20 years |

| ICICI | 9% – 11.5% | Up to 15 years |

| PNB | 9.25% – 11.75% | Up to 15 years |

Tip: If you have a high credit score (750+), you may qualify for the lowest rates.

Who Is Eligible for a Home Equity Loan?

Not everyone can get a home equity loan—banks have strict criteria. Here’s what you need:

1. Property Ownership

- You must be the legal owner.

- The property should be free from major legal disputes.

2. Income & Credit Score

- Salaried individuals: Minimum monthly income ₹25,000-₹30,000.

- Self-employed: Stable income for the last 2-3 years.

- CIBIL Score: 650+ (better rates for 750+).

3. Loan-to-Value (LTV) Ratio

Most banks lend 60-75% of your home’s current market value.

4. Age Limit

- Minimum age: 21 years

- Maximum age: 65-70 years (at loan maturity)

Best Banks for Home Equity Loans in India

1. SBI Home Equity Loan

- Interest Rate: 8.50% – 10.50%

- Max Loan Amount: ₹5 Crores

- Tenure: Up to 15 years

- Processing Fee: 0.35% – 1%

Why Choose SBI? Low interest rates and trusted service.

2. HDFC Home Equity Loan

- Interest Rate: 8.75% – 11%

- Max Loan Amount: ₹10 Crores

- Tenure: Up to 20 years

Why Choose HDFC? Higher loan amounts and flexible repayment.

3. ICICI Bank Home Equity Loan

- Interest Rate: 9% – 11.5%

- Quick Processing: As fast as 72 hours for existing customers.

Best For: Those who need fast approval.

How to Calculate Your Home Equity Loan EMI?

Before applying, use a home equity loan calculator to estimate your monthly payments.

Example Calculation:

- Loan Amount: ₹50 lakhs

- Interest Rate: 9%

- Tenure: 10 years

- EMI: ₹63,337 per month

Try It Yourself:

- Enter your loan amount.

- Choose interest rate & tenure.

- Check your EMI instantly.

Tax Benefits on Home Equity Loans

Did you know you can save on taxes with a home equity loan?

- Section 24(b): Interest paid is deductible (up to ₹2 lakh/year) if used for home renovation or buying a new property.

- No Tax Benefit: If funds are used for vacations, weddings, or debt repayment.

Frequently Asked Questions (FAQs)

1. Can I get a home equity loan if I already have a mortgage?

✅ Yes! Banks will consider your remaining mortgage balance and lend up to 75-80% of your home’s value.

2. Which is better—home equity loan or personal loan?

- Home equity loan: Lower interest, longer tenure, but requires collateral.

- Personal loan: No collateral, but higher interest (11-24%).

3. How long does approval take?

Approval usually takes 3-7 days if all documents are submitted.

4. Can I prepay my home equity loan?

✅ Yes, but some banks charge a 1-2% prepayment penalty.

Final Thoughts: Is a Home Equity Loan Right for You?

A home equity loan is a great option if you need a large sum at a low interest rate. However, since your home is at risk if you default, make sure you can afford the EMIs. Compare offers from SBI, HDFC, and ICICI, use a home equity loan calculator, and check eligibility before applying.

Need more financial tips? Check out our guides on:

Home Equity Loans in India: Your Complete Guide

Unlock the value of your property with smart borrowing

What is a Home Equity Loan?

A home equity loan lets you borrow against the value you’ve built up in your home. It’s like turning your property’s value into cash while still keeping ownership.

Current Interest Rates (2024)

| Bank | Interest Rate | Max Tenure |

|---|---|---|

| SBI | 8.50% – 10.50% | 15 years |

| HDFC | 8.75% – 11% | 20 years |

| ICICI | 9% – 11.5% | 15 years |

| PNB | 9.25% – 11.75% | 15 years |

Who Can Apply?

Homeowner with at least 25-40% equity

CIBIL score 650+ (750+ for best rates)

Stable income (₹25k+/month)

Age 21-65 years

Top Uses for Home Equity Loans

✅ Home Renovation (Tax benefits available)

✅ Education Expenses

✅ Medical Emergencies

✅ Debt Consolidation

✅ Business Investment

How to Calculate Your EMI

Use this simple formula to estimate your monthly payments:

Where:

P = Loan amount

R = Monthly interest rate (annual rate/12)

N = Loan tenure in months

Or use our online Home Equity Loan Calculator for instant results!

Hi, I’m Sandip Bhange, the person behind MyFinancePolicy. I’m a civil engineer who developed a strong interest in banking and personal finance over the years. I started this website to share clear, honest, and easy-to-understand information that can actually help people in their daily financial decisions.