Table of Contents

Discover the best investment apps in India for 2025. Our expert review compares features, fees, and security to help you grow your wealth smartly.

Best Investment Apps in India 2025 (Complete Review)

Gone are the days of cumbersome paperwork and calling your broker for every single trade. The Indian financial landscape has been revolutionized by fintech, putting the power of the market directly into the palm of your hand. But with so many options, how do you choose the right one? This comprehensive guide is designed to cut through the noise and help you find the best investment apps India has to offer in 2025. We’ll break down the top contenders based on user experience, fees, investment products, and security, empowering you to make an informed decision for your financial future.

What Makes an App One of the Best Investment Apps in India?

Before we dive into the list, it’s crucial to understand the criteria. A top-tier app is more than just a platform to buy stocks. When we evaluate the best investment apps India-based users should consider, we look at:

- User Interface (UI) & Experience (UX): Is the app intuitive and easy to navigate, especially for beginners?

- Range of Investment Products: Does it offer stocks, mutual funds, ETFs, IPOs, and more?

- Cost Structure: What are the brokerage fees, AMC charges, and other hidden costs?

- Research and Educational Tools: Does it provide quality market data, analysis, and learning resources?

- Security and Reliability: Is the platform robust, with strong security protocols like two-factor authentication?

The Top Contenders for the Best Investment Apps in India 2025

Based on the criteria above, here are our top picks for the most powerful and user-friendly investment platforms available today.

1. Zerodha: The Pioneer and Market Leader

Consistently ranked as one of the best investment apps India has produced, Zerodha revolutionized the industry with its discount brokerage model. Its flagship app, Kite, is renowned for its clean, fast, and powerful interface.

- Best For: Active traders and investors who value a no-fuss, efficient platform.

- Key Features: Zero brokerage on equity investments, low intraday and F&O charges, direct mutual funds, and extensive charting tools.

- Pricing: ₹0 brokerage on equity delivery trades; ₹20 or 0.03% (whichever is lower) for intraday and F&O.

- Considerations: Its advanced features can be slightly overwhelming for absolute beginners.

2. Groww: The Beginner’s Best Friend

Groww has masterfully tapped into the market of first-time investors. With an incredibly simple and intuitive UI, it has become a go-to app for millions looking to start their journey. It’s a strong contender for the title of best investment apps India for newcomers.

- Best For: First-time investors and those who prefer simplicity.

- Key Features: Easy access to direct mutual funds, a straightforward stock investing section, US stocks, and a wealth of educational content.

- Pricing: Zero brokerage on equity delivery and mutual funds. A small convenience fee is applied on other transactions.

- Considerations: Lacks the advanced trading tools that active traders might require.

3. Upstox: A Powerful Challenger

Formerly known as RKSV, Upstox is another major player in the discount brokerage space. It offers a compelling combination of low costs and a robust trading platform, making it another excellent choice among the best investment apps India provides for cost-conscious traders.

- Best For: Traders looking for a low-cost alternative with pro-level features.

- Key Features: Advanced charting with over 100 technical indicators, integration with TradingView, and low brokerage fees.

- Pricing: ₹0 brokerage on equity delivery trades; ₹20 per executed order for intraday, F&O, and currency.

- Considerations: The user interface, while powerful, is not as polished as Zerodha’s Kite.

4. Angel One: The Full-Service Experience, Reimagined

Angel One (formerly Angel Broking) successfully bridges the gap between traditional full-service brokers and modern discount brokers. Its Angel One app provides a wealth of research and advisory services alongside a smooth trading experience.

- Best For: Investors who want a blend of DIY investing and expert research.

- Key Features: Strong in-house research reports (ARQ), a free demat account, and access to IPOs and stock recommendations.

- Pricing: ₹0 brokerage on equity delivery and direct mutual funds; ₹20 per order for intraday and F&O.

- Considerations: The plethora of features and notifications can feel overwhelming to some.

5. ICICI Direct: The Trusted Traditional Giant

For investors who value the brand name and extensive research of a traditional bank-backed broker, ICICI Direct remains a formidable option. It may not be the cheapest, but it offers a comprehensive suite of services.

- Best For: Long-term, value-oriented investors who prefer a trusted brand and full-service support.

- Key Features: Extensive research, access to a wide range of products including bonds and insurance, and seamless integration with ICICI bank accounts.

- Pricing: Higher brokerage fees compared to discount brokers (e.g., 0.50% brokerage on delivery trades).

- Considerations: The fee structure is significantly higher than its discount broker competitors.

Comparison Table: Best Investment Apps India 2025

| App Name | Best For | Delivery Brokerage | Unique Selling Point |

|---|---|---|---|

| Zerodha | Active Traders | ₹0 | Powerful platform & ecosystem |

| Groww | Beginners | ₹0 | Extremely simple UI |

| Upstox | Cost-Conscious Traders | ₹0 | Low cost & pro features |

| Angel One | Research-Driven Investors | ₹0 | Advisory & Research (ARQ) |

| ICICI Direct | Full-Service Seekers | 0.50% | Brand Trust & Research |

How to Choose the Right App for You

Identifying the absolute best investment apps India wide depends entirely on your personal profile. Ask yourself these questions:

- What is your investment experience? Beginners should prioritize apps like Groww, while experienced traders will prefer Zerodha or Upstox.

- What are your investment goals? Are you building long-term wealth via SIPs, or are you an active day trader? Your strategy dictates the tools you need.

- What is your risk appetite? Ensure the app offers products that match your risk tolerance.

Ultimately, the best investment apps India has to offer are those that align with your financial goals and level of expertise. It’s why we see such a variety thriving in the market.

Security First: Protecting Your Investments

No discussion about the best investment apps India investors use is complete without addressing security. Always ensure your chosen app uses:

- Two-Factor Authentication (2FA)

- SEBI-registered and regulated protocols

- Data encryption for all transactions

Never share your password or OTP with anyone. The security of your portfolio is a shared responsibility between you and the platform. When looking for the best investment apps India wide, never compromise on security features.

FAQs: Your Questions Answered

Which is the safest investment app in India?

All SEBI-registered brokers, including the ones listed here (Zerodha, Groww, Upstox, etc.), are safe to use as they adhere to strict regulatory guidelines. Safety often comes down to using strong passwords and enabling 2FA on your account.

Can I use multiple investment apps?

Yes, it’s very common. You might use Zerodha for active trading and Groww for your mutual fund SIPs. However, managing multiple accounts can become cumbersome, so it’s often better to consolidate where possible.

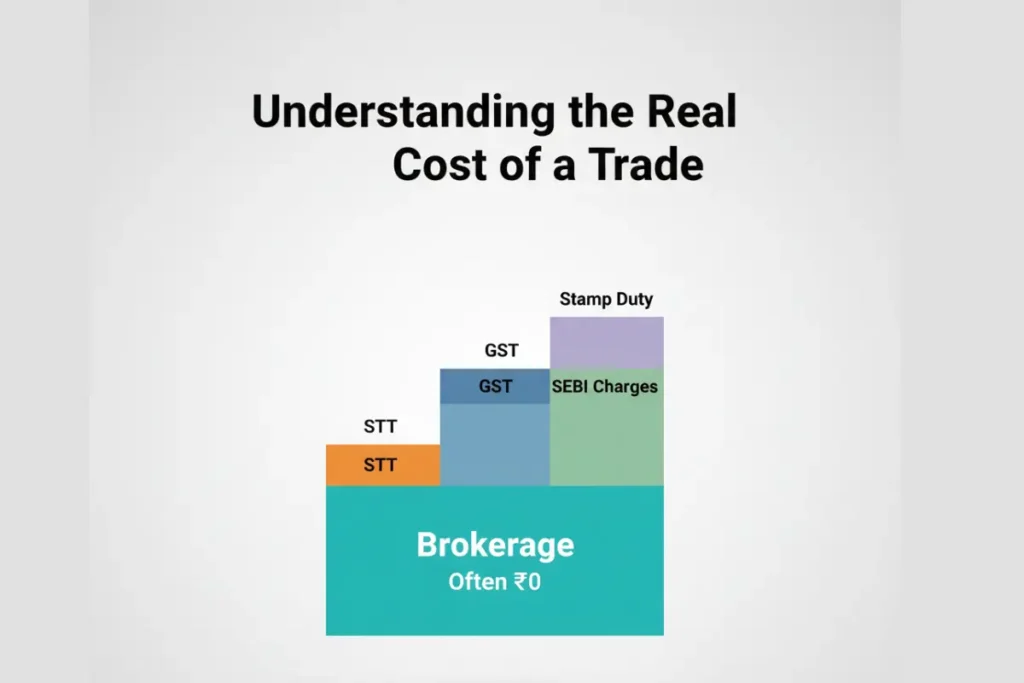

Are there any hidden charges in these apps?

While most advertise “zero brokerage,” be aware of other charges like Securities Transaction Tax (STT), GST, Stamp Duty, and SEBI charges. These are mandatory and apply to all brokers. Always check the detailed charge sheet on the app’s website.

What is the minimum amount needed to start investing?

You can start with as little as ₹100 in a mutual fund SIP or buy a single share of a company. The barrier to entry is incredibly low, which is a key reason these are considered the best investment apps India has for new investors.

Conclusion: Start Your Investment Journey Today

The democratization of investing in India is in full swing, and the tools have never been better. Whether you’re drawn to the power of Zerodha, the simplicity of Groww, or the research of Angel One, there is a perfect platform waiting for you. The key is to start. By choosing one of the best investment apps India offers in 2025, you are taking a crucial step towards taking control of your financial destiny.

Ready to build your wealth? Review our top picks, identify which app aligns with your goals, and open an account today. The future you will thank you for it.

Internal Linking Suggestions:

- Within the article, you could link “direct mutual funds” to an internal article explaining “What Are Direct Mutual Funds and Why They Outperform Regular Plans.”

- When mentioning “first-time investors,” link to a beginner’s guide like “A Beginner’s Guide to Stock Market Investing in India.”

External Linking Suggestions:

- Link each app’s name to its official website (e.g.,

zerodha.com). - Link to the SEBI website (

sebi.gov.in) when discussing regulation and safety to provide authoritative backing.

SEBI GOVERMENT WEBSITE

-

Your Complete Guide to the SBI Student Credit Card: How to Apply and Why You Should

Learn how to apply for the SBI student credit card, its key benefits, eligibility, and documents required. Build your credit history in India as a student. Apply today! Your Complete Guide to the SBI Student Credit Card: How to Apply and Why You Should Navigating university life often comes with new financial responsibilities. For students…

-

Beginner’s Guide to Mutual Fund Investment: How to Get Started

Explore our complete guide to mutual fund investment. Learn how it works, its benefits, types, and how to start building your portfolio today. Perfect for beginners. Your Complete Guide to Mutual Fund Investment Navigating the world of investing can feel overwhelming, with endless jargon and complex strategies. If you’re looking for a way to start…

-

Best Investment Apps in India 2025 (Complete Review)

Discover the best investment apps in India for 2025. Our expert review compares features, fees, and security to help you grow your wealth smartly. Best Investment Apps in India 2025 (Complete Review) Gone are the days of cumbersome paperwork and calling your broker for every single trade. The Indian financial landscape has been revolutionized by…

Hi, I’m Sandip Bhange, the person behind MyFinancePolicy. I’m a civil engineer who developed a strong interest in banking and personal finance over the years. I started this website to share clear, honest, and easy-to-understand information that can actually help people in their daily financial decisions.