Table of Contents

✅ How to Close Axis Bank Credit Card in 2 Easy Ways (Customer Care + Online Chat). Want to close Axis Bank Credit Card? Learn the step-by-step process to close your Axis Bank credit card using customer care and online chat. Avoid issues by following these simple methods!

📝 Introduction

Planning to Close Axis Bank Credit Card? Whether you’re switching banks, simplifying finances, or no longer using the card—closing it properly ensures no future complications.

In this blog post, we’ll show you two hassle-free methods to close Axis Bank Credit Card, what to do before you close it, and how to avoid common issues people face.

✅ Read till the end for FAQs and important links.

🔍 Pros & Cons of Closing a Credit Card

✅ Advantages

- 🛡️ Reduced Debt Risk: No risk of overspending on that card

- 💸 Saved Fees: Avoid annual or hidden maintenance charges

- 🧘 Financial Simplicity: Fewer cards = easier budget management

- 🔒 Improved Security: Less chance of fraud or misuse

⚠️ Disadvantages

- 📉 Lower Credit Score: Closing reduces your available credit limit, impacting your credit utilization ratio

- 📆 Shorter Credit History: May shorten your average account age (if it’s an old card)

- 💰 Lose Reward Points: Unused rewards may be lost after closure

- 🔁 Auto-payment Disruptions: EMI or subscription services may fail if linked to closed card

🔍 Why Close Axis Bank Credit Card?

Here are a few common reasons people choose to close Axis Bank Credit Card:

- High annual fees

- Limited rewards or benefits

- Duplicate cards

- Too many credit accounts

- Change in financial goals

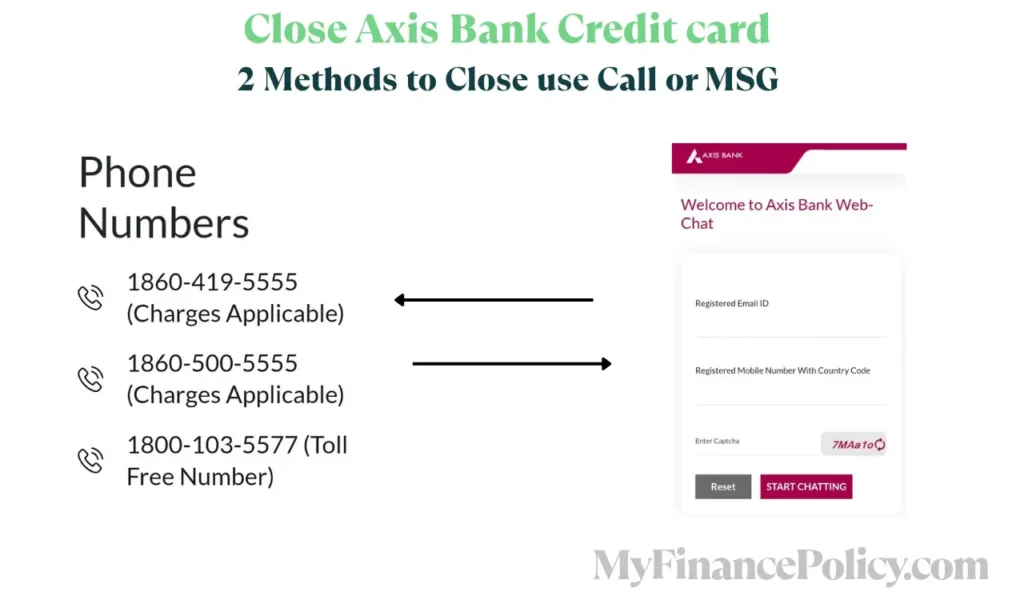

✅ Method 1: Close Axis Bank Credit Card via Customer Care

This is the most common and direct method.

📞 Step-by-Step Process:

- Call Customer Care:

- Dial:

1860 419 5555/1860 500 5555/1800 103 5577

(Use your registered mobile number)

- Dial:

- Verify Identity:

- Answer basic verification questions asked by the representative.

- Request Card Closure:

- Clearly mention that you want to close Axis Bank Credit Card.

- Ask for Written Confirmation:

- Request a closure confirmation via SMS or email.

- Settle All Dues:

- Ensure no outstanding balance is left on your card.

- Destroy the Card:

- Cut and dispose of the card securely once it’s closed.

✅ Use this official link to get the customer care info:

Axis Bank Credit Card Closure Contact

💬 Method 2: Close Axis Bank Credit Card via Online Chat

If you prefer not to call, you can close Axis Bank Credit Card online using their official chat support.

💻 Steps to Follow:

- Visit the Official Chat Page:

👉 Click here to open the Chat - Select the Issue:

- Choose “Cards” → “Credit Card” → “Card Closure”

- Chat with Representative:

- Provide required details and request to close Axis Bank Credit Card.

- Get Confirmation:

- Ask for closure proof via email or SMS.

📌 Things to Do Before You Close Axis Bank Credit Card

Important checklist before you proceed to close Axis Bank Credit Card:

- ✅ Pay All Outstanding Dues: Make full payment, including EMI if any.

- 🎁 Redeem Reward Points: Use them before losing access.

- 🔁 Cancel Auto-Payments: Update recurring bills linked to the card.

- 📊 Check Credit Score Impact: Avoid closing if it’s your oldest card or has a high credit limit.

🤔 FAQs – People Also Ask

❓ Can I close Axis Bank credit card online?

Yes. Use the official chat support link and request closure via chat.

❓ Will closing Axis Bank Credit Card affect my credit score?

It may, especially if it’s your oldest or highest-limit card. Consider your credit utilization ratio before closing.

❓ How long does it take to close Axis Bank Credit Card?

Usually 7 working days after successful verification and no outstanding dues.

❓ Is there a closure fee?

No, Axis Bank does not charge a fee for voluntarily closing a credit card.

❓ Can I reopen a closed credit card?

No. Once closed, the card cannot be reopened. You’ll need to apply for a new one.

📚 Read More Useful Guides

- Track Your Axis Credit Card Status

- Credit Card Bill Payment Apps

- Tata Neu Credit Card Benefits

- Student Credit Card Guide

🔚 Conclusion

Now you know how to close Axis Bank Credit Card using two simple methods—via customer care or online chat. Always make sure to clear dues, redeem points, and get proper confirmation. Avoiding these steps can lead to future financial confusion.

If you’re ready, pick the method that works best for you and close the Axis Bank credit card the right way.

✅ Summary Table

| Method | Tools Required | Time Taken |

|---|---|---|

| Customer Care | Phone, ID Details | 5-10 minutes |

| Online Chat | Internet, ID Details | 10-15 minutes |

🛑 How to Close Axis Bank Credit Card

✅ Method 1: Customer Care (Phone Call)

- 📞 Call: 1860 419 5555 / 1860 500 5555 / 1800 103 5577

- 🔐 Verify Identity: Answer basic questions to confirm your identity

- ❌ Request Closure: Tell the executive to close Axis Bank Credit Card

- 📩 Get Confirmation: Ask for SMS/email proof of card closure

- 💳 Settle Dues: Clear any outstanding bills or EMIs

- ✂️ Destroy Card: Cut the physical card after confirmation

💬 Method 2: Online Chat Support

- 🌐 Visit Chat Page: Click Here

- 🧾 Choose Issue: Select “Credit Cards” → “Card Closure”

- 💬 Initiate Chat: Provide your card and identity details

- 📧 Get Confirmation: Ask for closure receipt via email/SMS

📌 Pre-Closure Checklist

- ✔️ Pay all dues or EMIs

- 🎁 Redeem all reward points

- 🔁 Cancel automatic payments linked to the card

- 📊 Consider credit score effect if card is old/high-limit

🧾 Summary: Compare Both Methods

| Method | Requirements | Time Taken |

|---|---|---|

| Customer Care Call | Phone, Identity Details | 5–10 minutes |

| Online Chat | Internet, Card Info | 10–15 minutes |

3 thoughts on “How to Close Axis Bank Credit Card Using 2 Easy Methods (Step-by-Step Guide)”