Table of Contents

Post Office Savings Schemes

Learn everything about Post Office Savings Schemes: types, interest rates, tax benefits, eligibility, and why they’re the safest investment choice.

Introduction

When it comes to choosing a safe investment, Post Office Savings Schemes have been one of the most trusted financial products in India for decades. Backed by the Government of India, these schemes are designed to encourage savings, promote financial security, and provide steady returns to individuals across urban and rural areas.

While stock markets and mutual funds attract those willing to take risks, millions of Indian families still prefer the guaranteed returns and peace of mind that post office schemes bring. Whether it’s a retiree looking for fixed monthly income, a parent saving for their daughter’s education, or a taxpayer planning for deductions under Section 80C, there’s a post office scheme for everyone.

In this article, we’ll cover all types of Post Office Savings Schemes, their features, eligibility, interest rates, benefits, and how they compare with other investment options. By the end, you’ll have a complete guide to help you decide whether post office schemes should be part of your financial portfolio.

What Are Post Office Savings Schemes?

Post Office Savings Schemes are small savings instruments offered through India Post. These schemes are unique because they combine government-backed security with affordable minimum deposits, making them accessible to millions of households.

Key Features of Post Office Savings Schemes

- Backed by the Government of India → virtually zero risk of default.

- Variety of options → short, medium, and long-term schemes.

- Tax benefits on selected schemes under Section 80C.

- Accessible across India → available at over 1.5 lakh post office branches.

- Affordable for everyone → minimum investments start as low as ₹100 or ₹250.

These features make Post Office Schemes suitable for both low-income groups seeking safety and middle-class families planning long-term wealth creation.

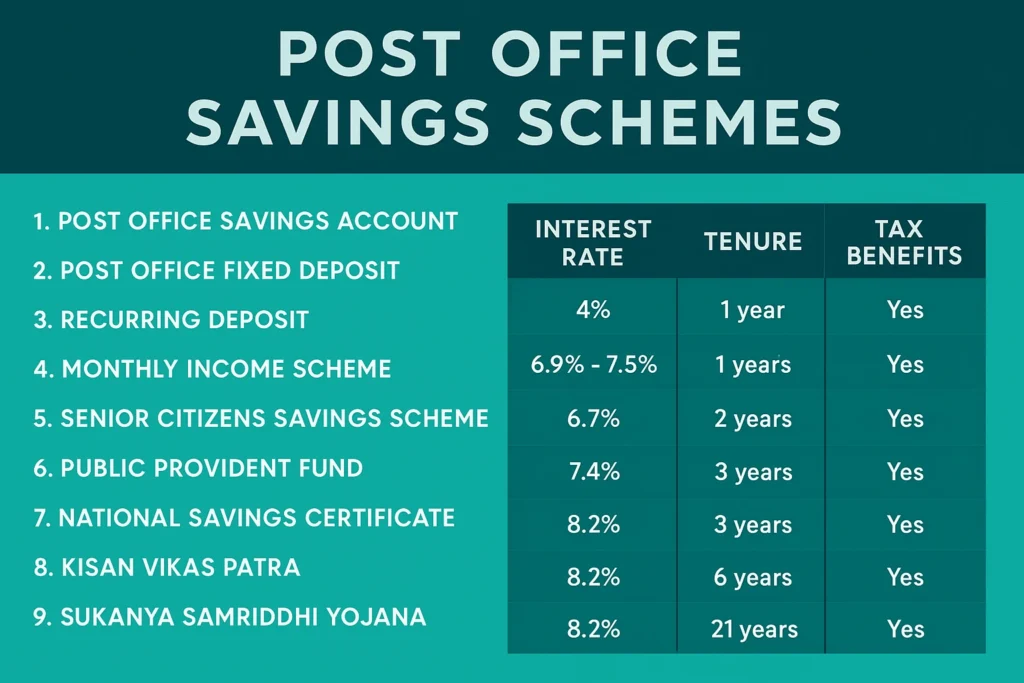

Types of Post Office Savings Schemes

Here’s a detailed look at all the major Post Office Savings Schemes available today:

1. Post Office Savings Account (POSA)

Much like a bank savings account, the Post Office Savings Account provides a safe space to park your money while earning modest interest.

- Minimum balance: ₹500.

- Current interest rate: 4% per annum.

- Account type: Available for both individuals and joint holders.

- Facilities: Cheque book, ATM card, and nomination facility.

👉 Best for individuals who want a simple and safe savings account in areas where banking facilities are limited.

2. Post Office Fixed Deposit (FD) / Time Deposit (TD)

The Post Office FD, also called Time Deposit, is one of the most popular products.

- Tenure options: 1, 2, 3, and 5 years.

- Interest rates: Ranging from 6.9% to 7.5% per annum.

- Minimum deposit: ₹1,000, no upper limit.

- Tax benefits: 5-year FD qualifies for Section 80C deduction.

👉 Ideal for conservative investors looking for guaranteed returns over fixed tenures.

3. Recurring Deposit (RD)

The Post Office RD helps you build savings gradually by investing small amounts every month.

- Tenure: 5 years.

- Interest rate: 6.7% per annum, compounded quarterly.

- Minimum deposit: ₹100/month, no maximum limit.

- Premature closure allowed after 3 years with penalty.

👉 Perfect for salaried individuals who want to save systematically.

4. Monthly Income Scheme (MIS)

This scheme is designed to provide a steady monthly income.

- Minimum deposit: ₹1,000.

- Maximum investment: ₹9 lakh (single) / ₹15 lakh (joint).

- Interest rate: 7.4% per annum.

- Tenure: 5 years.

👉 A reliable option for retirees or those who want a fixed monthly income stream.

5. Senior Citizens Savings Scheme (SCSS)

Exclusively for senior citizens (60+), the SCSS is one of the most rewarding schemes.

- Tenure: 5 years (extendable by 3 years).

- Maximum deposit: ₹30 lakh.

- Current rate: 8.2% per annum.

- Tax benefits: Eligible under Section 80C.

👉 The best option for retirees who want high, guaranteed interest and safety.

6. Public Provident Fund (PPF)

The PPF is a long-term savings scheme with unmatched tax benefits.

- Tenure: 15 years (extendable in blocks of 5 years).

- Investment limit: ₹500 – ₹1.5 lakh per year.

- Interest rate: 7.1% per annum, compounded annually.

- Tax benefits: EEE (Exempt-Exempt-Exempt) status → Contributions, returns, and withdrawals are all tax-free.

👉 Great for long-term wealth creation and tax savings.

7. National Savings Certificate (NSC)

A popular fixed-return instrument for individuals looking for tax benefits.

- Tenure: 5 years.

- Interest rate: 7.7% per annum.

- Minimum deposit: ₹1,000.

- Tax benefit: Section 80C deduction up to ₹1.5 lakh.

👉 A low-risk investment option ideal for taxpayers.

8. Kisan Vikas Patra (KVP)

Designed to encourage long-term savings with the feature of doubling your money.

- Maturity: ~115 months (9 years 7 months).

- Interest rate: 7.5% per annum.

- Minimum deposit: ₹1,000.

- No maximum limit.

👉 Suitable for long-term conservative investors.

9. Sukanya Samriddhi Yojana (SSY)

A scheme focused on the welfare of the girl child.

- Eligibility: Parents/guardians of a girl under 10 years.

- Tenure: 21 years or until marriage after 18 years.

- Interest rate: 8.2% per annum.

- Investment limit: ₹250 – ₹1.5 lakh annually.

- Tax benefits: Section 80C + tax-free returns.

👉 Excellent for parents planning for their daughter’s higher education or marriage.

Benefits of Post Office Savings Schemes

Investing in Post Office Savings Schemes comes with several advantages:

- Safety & Security – Backed by the Government of India, making them risk-free.

- Decent Returns – Higher than bank savings accounts.

- Tax Benefits – Available on PPF, NSC, SCSS, and SSY.

- Accessibility – Post offices are present in nearly every village and town.

- Flexibility – Schemes for all age groups and financial goals.

- Affordability – Start with very small amounts.

Who Should Invest in Post Office Savings Schemes?

These schemes are perfect for:

- Senior citizens and retirees – seeking steady, guaranteed income.

- Conservative investors – who want safety over high-risk stock market returns.

- Taxpayers – looking for deductions under Section 80C.

- Parents – saving for their child’s future education and marriage.

- Individuals in rural areas – with limited access to banks.

Comparison: Post Office Savings Schemes vs Bank FDs

| Feature | Post Office Schemes | Bank Fixed Deposits |

|---|---|---|

| Safety | Govt. of India backed | DICGC insured (up to ₹5 lakh) |

| Returns | 6.7% – 8.2% | 5.5% – 7.5% |

| Tax Benefits | Available on many schemes | Only on 5-year FD |

| Accessibility | Widely available | Limited to bank branches/online |

| Target Audience | Rural + conservative investors | Urban + general investors |

Things to Consider Before Investing

- Interest rates are revised quarterly by the government.

- Some schemes have lock-in periods (e.g., PPF – 15 years).

- Early withdrawal may lead to penalties in certain schemes.

- Not all schemes are tax-free (only selected ones).

FAQs – Post Office Savings Schemes

1. Are Post Office Savings Schemes safe?

Yes, they are 100% secure as they are backed by the Government of India.

2. Can NRIs invest in these schemes?

No, only resident Indians are eligible to invest.

3. Which scheme is best for senior citizens?

The Senior Citizens Savings Scheme (SCSS) offers the highest returns and is tailor-made for retirees.

4. Can I open Post Office accounts online?

Some services are available through India Post’s online portal, but most schemes still require a visit to the post office.

5. Which scheme gives the highest return?

Currently, SCSS (8.2%) and Sukanya Samriddhi Yojana (8.2%) offer the best returns.

6. Do Post Office schemes provide tax benefits?

Yes, schemes like PPF, NSC, SSY, and SCSS qualify for deductions under Section 80C.

Conclusion

Post Office Savings Schemes continue to be one of the safest, most accessible, and reliable investment options in India. From senior citizens seeking monthly income to parents planning for their child’s future, these government-backed schemes offer something for everyone.

👉 If you value safety, tax savings, and steady growth, Post Office Schemes should be part of your investment portfolio. To build wealth faster, consider combining them with market-linked options like mutual funds for a balanced strategy.

Call to Action: Ready to secure your future with guaranteed returns? Explore Post Office Savings Schemes today and choose the one that aligns with your financial goals.

Internal Linking Suggestions

- “Best Long-Term Investment Options in India”

- “Fixed Deposit vs Recurring Deposit: Which Is Better?”

External Linking Suggestions

Hi, I’m Sandip Bhange, the person behind MyFinancePolicy. I’m a civil engineer who developed a strong interest in banking and personal finance over the years. I started this website to share clear, honest, and easy-to-understand information that can actually help people in their daily financial decisions.